why cryptocurrency is good for the economy

why cryptocurrency is good for the economy has emerged as a transformative force in the global economy, offering a range of benefits that can drive economic growth and innovation. By leveraging blockchain technology, cryptocurrencies provide an alternative to traditional financial systems, promoting inclusivity, efficiency, and transparency. This article explores the reasons why cryptocurrency is good for the economy, highlighting its potential to enhance financial inclusion, streamline transactions, create new investment opportunities, and foster technological advancement.

Enhancing Financial Inclusion why cryptocurrency is good for the economy

Access to Financial Services

One of the most significant advantages of cryptocurrency is its potential to enhance financial inclusion. In many parts of the world, particularly in developing countries, a substantial portion of the population lacks access to traditional banking services. Cryptocurrencies provide an accessible financial system that can be used by anyone with an internet connection.

Benefits:

- Banking the Unbanked: Cryptocurrencies enable individuals without access to traditional banks to participate in the global economy, allowing them to store, send, and receive money securely.

- Lowering Barriers to Entry: Traditional banking often requires documentation and fees that can be prohibitive for low-income individuals. Cryptocurrencies reduce these barriers, offering a more inclusive financial solution.

Reducing Remittance Costs

Remittances, or money sent by migrants to their home countries, are a crucial source of income for many families in developing nations. Traditional remittance services can be slow and expensive, with high fees that cut into the amount received by the beneficiaries. Cryptocurrencies offer a faster, cheaper alternative for cross-border transactions.

Benefits:

- Lower Transaction Fees: Cryptocurrencies often have lower transaction fees compared to traditional remittance services, allowing more money to reach the recipients.

- Faster Transactions: Cryptocurrencies can process transactions in minutes, compared to the days it may take for traditional services.

Streamlining Transactions

Faster and Cheaper Payments

Cryptocurrency transactions are processed on decentralized networks, which can offer significant improvements in speed and cost over traditional banking systems.

Benefits:

- Instant Settlements: Cryptocurrency transactions can be settled almost instantly, reducing the time and uncertainty associated with traditional banking transfers.

- Reduced Transaction Costs: By eliminating intermediaries such as banks and payment processors, cryptocurrencies can lower the cost of transactions for both businesses and consumers.

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts run on blockchain technology and can automatically enforce the terms of an agreement without the need for intermediaries.

Benefits:

- Efficiency and Automation: Smart contracts automate processes that traditionally require manual intervention, reducing the potential for errors and increasing efficiency.

- Trust and Security: Because smart contracts are immutable and transparent, they build trust among parties and reduce the risk of fraud.

Creating New Investment Opportunities

New Asset Class

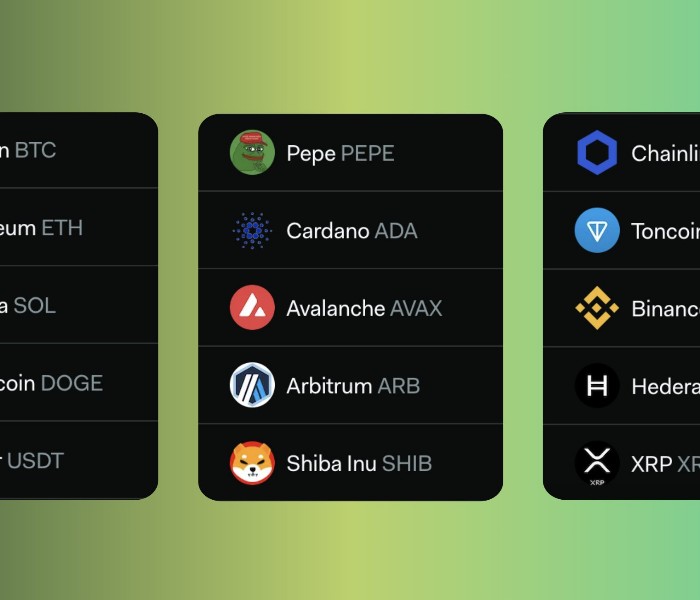

Cryptocurrencies represent a new asset class that offers unique investment opportunities. As the market matures, it provides both retail and institutional investors with diversification options beyond traditional assets like stocks and bonds.

Benefits:

- Diversification: Investing in cryptocurrencies can diversify investment portfolios, potentially reducing risk and enhancing returns.

- High Growth Potential: Cryptocurrencies have shown significant growth potential, attracting investors seeking high returns.

Fundraising through ICOs and STOs

Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) are innovative fundraising methods enabled by cryptocurrency technology. These methods allow startups and businesses to raise capital from a global pool of investors.

Benefits:

- Access to Capital: Cryptocurrencies provide new avenues for businesses to access capital, especially those that may struggle to secure funding through traditional means.

- Global Reach: ICOs and STOs can attract investors from around the world, increasing the potential pool of capital.

Fostering Technological Advancement

Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, refers to a new financial system built on blockchain technology that aims to recreate and improve traditional financial services, such as lending, borrowing, and trading.

Benefits:

- Innovation in Financial Services: DeFi is driving innovation in the financial sector, creating new financial products and services that are more accessible, efficient, and secure.

- Economic Growth: By democratizing access to financial services and encouraging innovation, DeFi can contribute to economic growth and development.

Blockchain Technology

The underlying technology of cryptocurrencies, blockchain, has applications beyond digital currencies. Blockchain technology can be used to improve transparency, security, and efficiency in various industries, including supply chain management, healthcare, and real estate.

Benefits:

- Transparency and Trust: Blockchain’s immutable ledger provides transparency and builds trust in transactions, reducing the risk of fraud.

- Efficiency and Cost Savings: By streamlining processes and eliminating intermediaries, blockchain can reduce costs and increase efficiency in various sectors.

Promoting Economic Resilience

Decentralization

Cryptocurrencies operate on decentralized networks, which are not controlled by any single entity. This decentralization can enhance economic resilience by reducing the risk of systemic failures in the financial system.

Benefits:

- Reduced Centralization Risks: Decentralized systems are less vulnerable to the risks associated with centralized control, such as corruption, mismanagement, and single points of failure.

- Enhanced Security: Decentralized networks can be more secure, as they distribute the risk and reduce the likelihood of a single point of attack.

Alternative Financial System

Cryptocurrencies provide an alternative to traditional financial systems, which can be particularly beneficial during times of economic uncertainty or crisis. By offering a decentralized, secure, and transparent financial system, cryptocurrencies can help stabilize economies and provide a reliable store of value.

Benefits:

- Hedge Against Inflation: Cryptocurrencies, particularly those with a fixed supply like Bitcoin, can serve as a hedge against inflation and currency devaluation.

- Economic Stability: In countries with unstable economies or weak financial systems, cryptocurrencies can offer a more stable alternative for storing and transferring value.

Challenges and Considerations

Regulatory Challenges

While cryptocurrency offers many benefits, it also presents regulatory challenges. Governments and regulatory bodies are still grappling with how to effectively regulate this new asset class to protect consumers and ensure financial stability.

Considerations:

- Regulatory Clarity: Clear and consistent regulatory frameworks are needed to foster innovation while protecting consumers and the financial system.

- Balancing Innovation and Security: Regulators must strike a balance between encouraging innovation and preventing illicit activities, such as money laundering and fraud.

Volatility

Cryptocurrencies are known for their price volatility, which can be a double-edged sword. While volatility presents opportunities for high returns, it also poses risks for investors and businesses.

Considerations:

- Risk Management: Investors and businesses must develop strategies to manage the risks associated with cryptocurrency volatility.

- Stablecoins: Stablecoins, which are cryptocurrencies pegged to stable assets like fiat currencies, offer a potential solution to volatility by providing price stability.

Adoption and Education

Widespread adoption of cryptocurrency requires education and awareness. Many people are still unfamiliar with how cryptocurrencies work and their potential benefits.

Considerations:

- Education and Outreach: Efforts to educate the public and businesses about cryptocurrencies and blockchain technology are essential to drive adoption.

- User-Friendly Solutions: Developing user-friendly cryptocurrency solutions can help bridge the gap and make it easier for people to adopt and use digital currencies.

Conclusion why cryptocurrency is good for the economy

Cryptocurrency has the potential to significantly impact the global economy by enhancing financial inclusion, improving transaction efficiency, offering new investment opportunities, and driving innovation. While there are challenges to address, the benefits of cryptocurrency make it a valuable tool for economic growth and development. As the technology matures and regulatory frameworks evolve, the positive impact of cryptocurrency on the economy is likely to become even more pronounced.

Embracing cryptocurrency and its underlying technology, blockchain, can pave the way for a more inclusive, efficient, and innovative economic future. By providing accessible financial services, reducing transaction costs, creating new investment opportunities, and fostering technological advancement, cryptocurrency can play a crucial role in shaping a resilient and dynamic global economy.